Search for Unclaimed Money in Colorado

Colorado holds more than $2.5 billion in lost funds and forgotten assets waiting to be claimed by their rightful owners. The Great Colorado Payback program helps people find unclaimed money from old bank accounts, uncashed checks, insurance refunds, utility deposits, and safe deposit box contents. Anyone can search the state database for free using a name or business. The State Treasurer's Office keeps these funds safe until you claim what belongs to you. Search the online database today to see if Colorado is holding money in your name.

Colorado Unclaimed Money Quick Facts

What is Unclaimed Property

Unclaimed property is any financial asset that has had no owner contact or activity for a certain period of time. Banks, insurance companies, employers, and other businesses must turn over these dormant accounts to the state after the dormancy period expires. Common types of unclaimed money include checking accounts, savings accounts, certificates of deposit, stocks, bonds, dividends, payroll checks, utility refunds, insurance proceeds, and safe deposit box contents.

The state does not take ownership of your property. Instead, the Colorado State Treasurer's Office acts as a custodian, safeguarding these assets until the rightful owner or heir comes forward to claim them. There is no time limit for filing a claim. Your property remains available to claim forever, and the state provides this service at no cost. You never need to pay anyone to help you search or file a claim for unclaimed money in Colorado.

Colorado is currently holding unclaimed property for millions of individuals and businesses across all 64 counties. The Great Colorado Payback database contains over 16.5 million names. Every year, the program processes more than 86,000 claims worth nearly $80 million. Since the program began, Colorado has returned over $858 million to rightful owners.

The Great Colorado Payback homepage provides access to the full search database. The site shows basic information about each property listing, including the owner name, last known address, property type, and the business that reported it. Start your search by entering a first name, last name, or both. You can narrow results by adding a city name if you know where the owner lived.

The state database updates regularly as new unclaimed property gets reported to the Treasurer's Office. Businesses and financial institutions must report and remit dormant accounts by November 1 each year, with insurance companies reporting by May 1. This means new names appear in the database throughout the year as holders submit their annual reports.

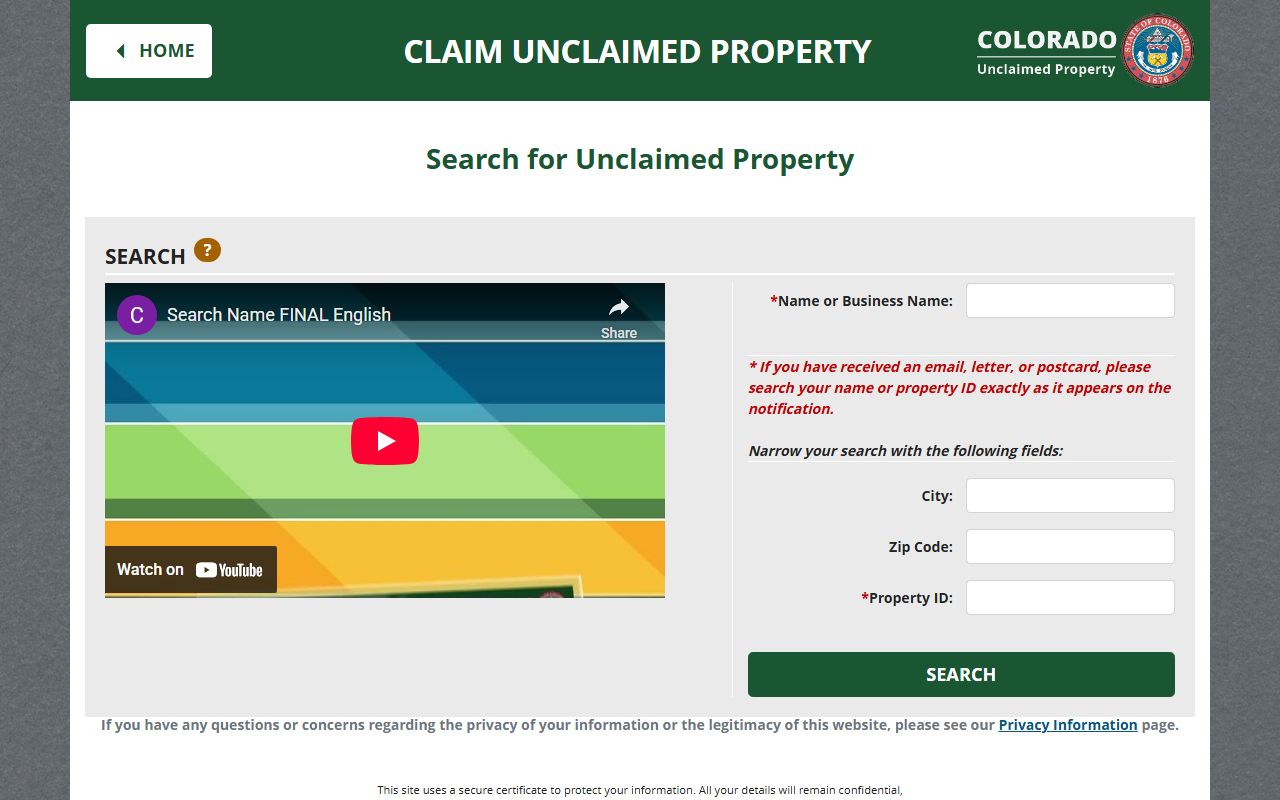

Search the Database for Free

Colorado provides a free online search tool that anyone can use. No registration is required. Visit the property search page and type in a name. The system searches the entire database and shows all matches. Results appear instantly on the screen.

You should search for variations of your name. Try your full legal name first, then search using nicknames or maiden names. Check for deceased relatives too, as heirs can claim property belonging to someone who has passed away. Business owners should search their company name and any former business names they used.

Each search result shows key details about the property. You can see the property type, the holder who reported it, and an approximate value range. Click on any result to view more information and start a claim. The online claim process walks you through each step and tells you what documents you need to prove ownership.

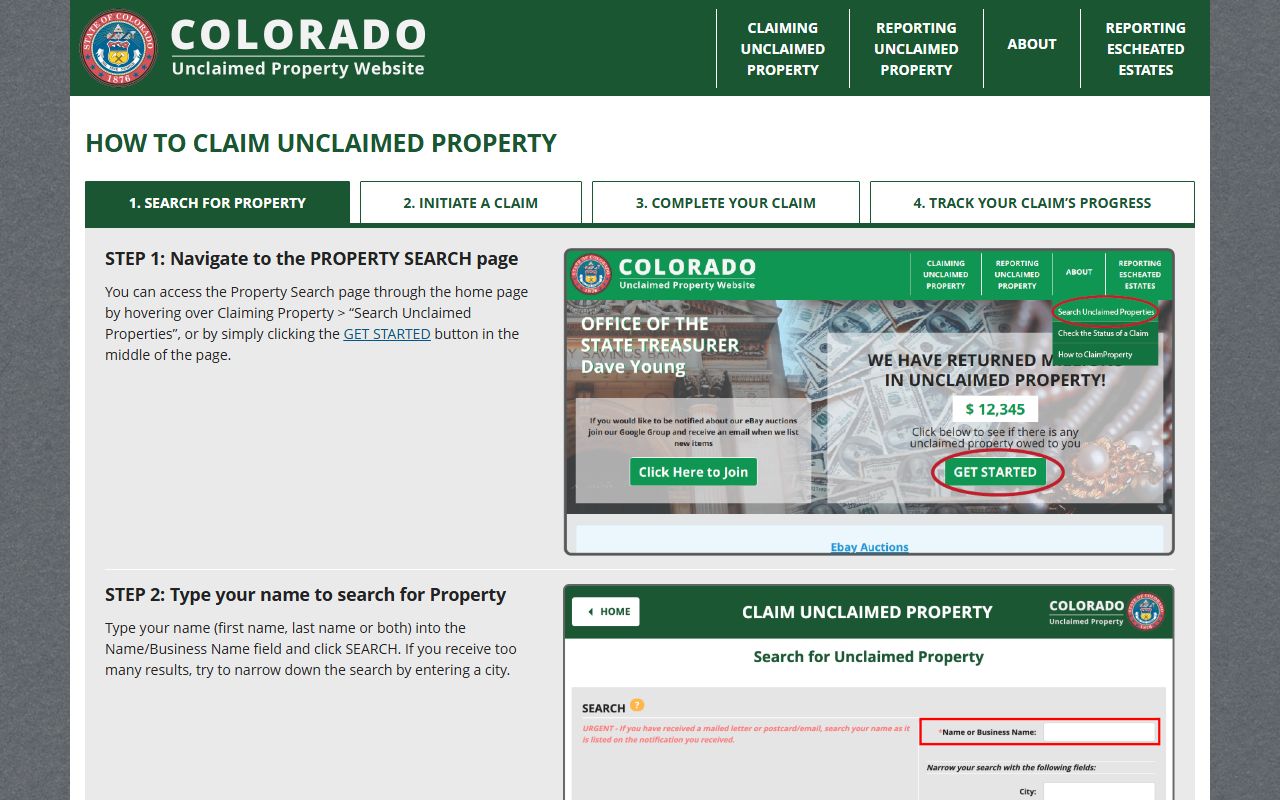

How to Claim Your Money

Filing a claim is simple and free. The state provides all forms at no charge, and you never need to hire a third party to assist you. Most people can complete the entire process online. Start by searching the database and identifying property that belongs to you. Click the "Claim It" button next to your name to begin.

The claim process guide explains what you need. Basic claims require proof of identity and proof of address. Common documents include a driver's license, state ID, passport, utility bill, or bank statement. For claims over $1,000, you must get your signature notarized on the claim form.

Claims for deceased owners require additional documentation. Heirs must submit a death certificate and proof of their relationship to the deceased owner, such as a will, probate documents, or affidavit of heirship. The state reviews all inheritance claims carefully to ensure property goes to the right person.

After you submit your claim, the state has 90 days by law to review it and issue payment. Most claims process much faster than that. The average claim resolves in just 11 days. More complex claims involving estates or businesses may take the full 90 days or longer if additional verification is needed. You can check your claim status online using the claim status search tool.

The state sends payments by check. Colorado recently started issuing checks proactively when they can positively identify the owner without requiring a formal claim. If you receive an unexpected check from the State Treasurer, it is legitimate. Cash it right away.

Legal Rules and Requirements

Colorado unclaimed property law is found in the Colorado Revised Statutes Title 38, Article 13. The state adopted the Revised Uniform Unclaimed Property Act in 2019 through Senate Bill 19-088, which took effect on July 1, 2020. This law updated Colorado's framework to match modern standards used by most other states.

The statute sets dormancy periods for different types of property. Wages and payroll checks become presumed abandoned after one year of no contact with the employee. Bank accounts, utility deposits, and most other property types have a five-year dormancy period. Stocks and dividends have a three-year period. Money orders remain with the issuer for seven years before transfer to the state. Under CRS 38-13-201, these periods begin when the owner last had contact with the holder or showed interest in the property.

Businesses must perform due diligence before sending property to the state. CRS 38-13-501 requires holders to send written notice to the last known address of any owner with property valued at $50 or more. The notice must go out between 60 and 120 days before the holder submits their annual report. If the owner responds to the notice, the property does not get reported as unclaimed.

Colorado changed its local government rules in 2025. House Bill 25-1224 repealed the local government exemption that previously existed under CRS 38-13-1504. All cities, counties, and special districts must now comply with state unclaimed property law. Local governments must report and remit dormant accounts by November 1 each year, just like businesses. Senate Bill 25-068 created an exception for municipally owned utilities, allowing them to use unclaimed deposits for bill payment assistance programs instead of sending the funds to the state.

The Great Colorado Payback Program

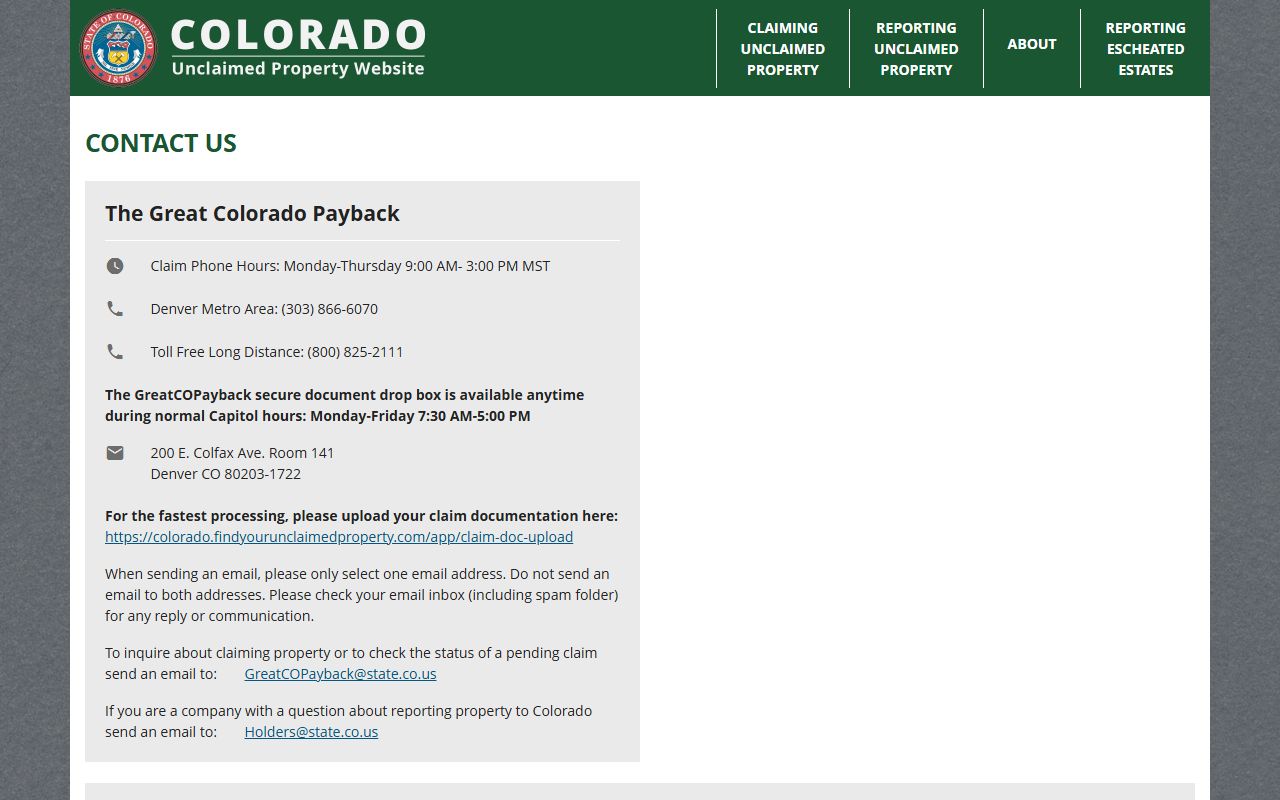

The Division of Unclaimed Property operates within the Colorado State Treasurer's Office. State Treasurer Dave Young oversees the program, with Bianca Gardelli serving as the Unclaimed Property Director. The division maintains offices in Denver at 200 E. Colfax Ave., Room 141.

Staff members answer questions and help people file claims by phone Monday through Thursday from 9:00 AM to 3:00 PM Mountain Time. Call 303-866-6070 if you're in the Denver metro area, or use the toll-free line at 800-825-2111. You can also email questions about claims to GreatCOPayback@state.co.us. Businesses with questions about holder reporting should email Holders@state.co.us.

The general FAQ page answers common questions about unclaimed property. Topics include what types of property get reported, why businesses turn funds over to the state, how long the claim process takes, and whether there are any fees. The FAQ section helps people understand the program before they start a search or file a claim.

Colorado also participates in MissingMoney.com, a nationwide database that searches multiple states at once. This free service helps people who have lived in different states search many databases with a single query. The site links back to each state's official claim process.

The state vault in Denver holds physical items from safe deposit boxes. These unique items include gold bars, vintage jewelry, rare coins, military medals, antique watches, historical documents, and collectible baseball cards. When banks close or customers abandon safe deposit boxes, the contents go to the state for safekeeping. Owners can claim these items the same way they claim financial assets.

The state does not charge any fees for this service. You should never pay a company or individual to search for unclaimed property or file a claim on your behalf. Some businesses offer to help find unclaimed money for a percentage of the recovered amount. Colorado allows these "heir finder" agreements only if they are signed after the property is reported to the state, not before. Anyone can search the database and file claims without paying a fee.

Information for Property Holders

Businesses and financial institutions must report unclaimed property annually. The reporting guidelines explain what to report and when. Most holders must submit their reports by November 1. Life insurance companies and financial institutions holding insurance proceeds must report by May 1. These deadlines are set by CRS 38-13-403.

Holders submit reports electronically through the online reporting system. The system accepts various file formats and walks holders through the submission process. Detailed instructions cover file layout requirements, property codes, and validation rules. First-time filers can contact the holder support team for assistance.

The state provides a holder deadlines page that lists all important dates for the reporting year. This includes due diligence notification periods, report submission deadlines, and payment remittance dates. Holders who miss deadlines may face interest charges and penalties under CRS 38-13-1204.

All holder forms are available on the forms page. This includes the Holder Report of Unclaimed Property, verification of lawful possession forms, and voluntary disclosure agreements for holders who discover past reporting errors. The state encourages voluntary compliance and works with businesses to resolve reporting issues.

Note: Penalties for non-compliance can include interest on unreported property and civil fines.

Browse by Location

Counties

Each of Colorado's 64 counties refers unclaimed property to the state program. County treasurers handle property taxes and may hold some funds temporarily, but most unclaimed money ends up with the State Treasurer. View county-specific information to find local treasurer contact details.

Adams County | Arapahoe County | Boulder County | Denver County | El Paso County | Jefferson County

View All 64 Colorado Counties →

Cities

Major cities in Colorado follow the state unclaimed property system. Some cities maintain local unclaimed funds lists for city-issued checks and refunds, but the primary database is managed at the state level. Search city pages for local government contact information.

Denver | Colorado Springs | Aurora | Fort Collins | Lakewood